A recurring theme in tax conversations lately has been the issue of businesses and whether they pay their fair share in taxes.

The theme is misguided as it is impossible for businesses to pay taxes. Rather taxing businesses really is just a way for policymakers to hide the cost of government from its residents.

For example, when businesses are taxed it is paid in various ways. They either increase the cost of their product to their customers to pay for the tax, pay their employees less than they could to pay the tax or withhold revenue to their shareholders or owners to cover the cost they are being charged for taxes. In the end it is still a tax paid for by people and not “business.”

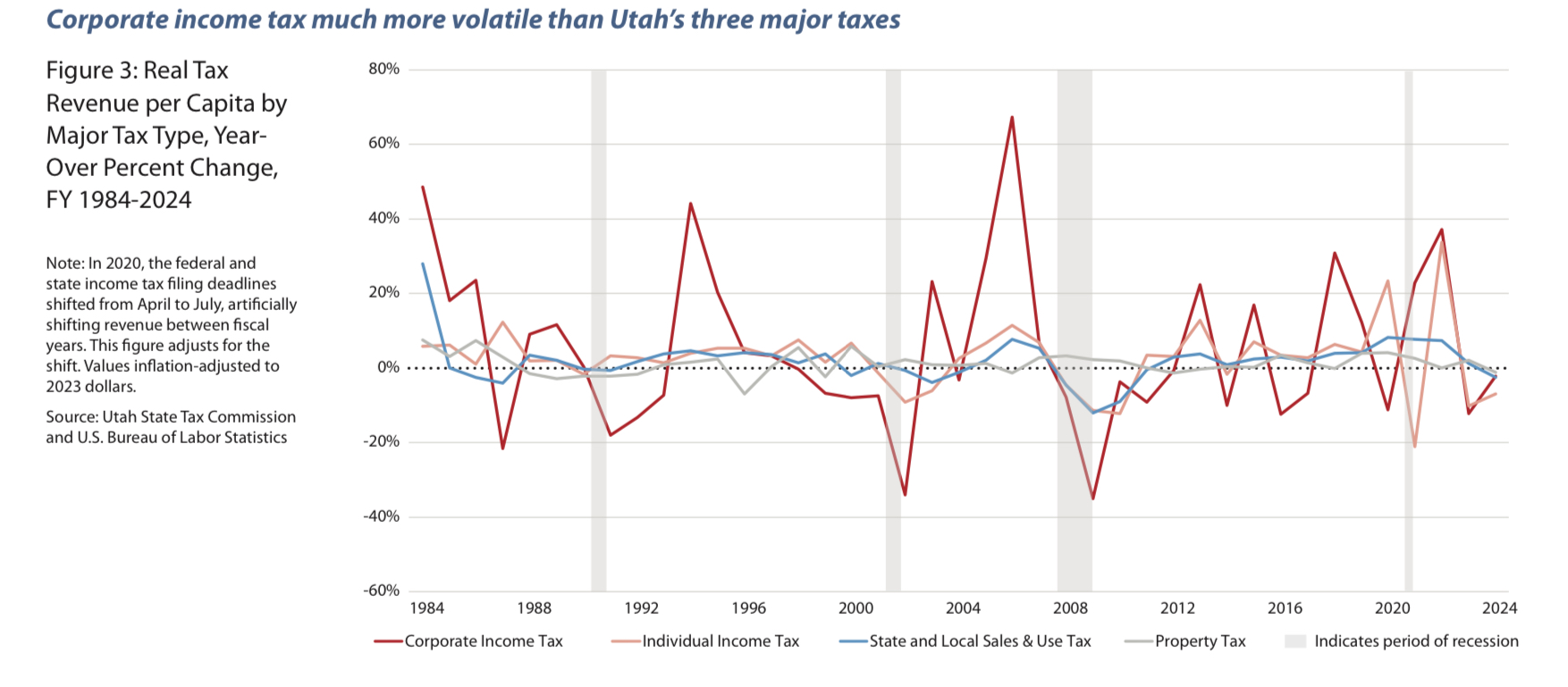

In addition to being a hidden tax on residents of the state, the corporate income tax is the most volatile of Utah’s three major taxes proving to be an income stream for the state that cannot be counted on from year to year to help fund government programs.

According to a study released by the Kem C. Gardner Policy Institute in December, corporate income taxes have raised as much as $900 million in one year but with that volatility the tax may also dip by a significant amount in the future. This makes the tax hard to count on for ongoing costs and poses another problem with shifting taxes on businesses. You can read the Institute’s full report here.

Making businesses pay their fair share of taxes also comes up in property tax discussions often in our state. What is usually forgotten in those talks is that businesses are already paying more than their fair share in property taxes as Utah already exempts residential properties valuations by 45%. That means for every $100,000 of property value for a primary residential home, only $55,000 is counted when assessing property taxes. That means business properties in the state are assessed at the 100% value of their property and are carrying a heavier burden to cover the cost of government services.

To put it another way, two individuals may want to open their own accounting firm. One does so out of their house, while another may open their business on a commercial property. The one who runs their business at home will avoid paying the full 100% property tax for their business while the other who runs it out of an office is paying the full price.

This is not an article to say homeowners should pay more in taxes but rather illustrating the point that businesses are paying a significant amount in taxes and that policymakers need to recognize their efforts when looking at tax policy decisions.

The phrase “businesses need to pay their fair share” needs to be eliminated from these discussions. Rather, lawmakers should focus on how revenue for the government can be raised in ways that focus the cost most of those who benefit from the services and not hide the cost on those who create jobs and add to the quality of life in the state of Utah.